The Hottest Nearshore Call Center Outsourcing Countries

Learn more about nearshore outsourcing, what it is and why it is so hot today.

We have discussed the prevailing perceptions of global outsourcing in previous articles. The topic always spurs a lot of conversation; however, there is still a common mislabeling of where outsourcing occurs and what it actually is. For example, not all outsourcing is offshore. And not all offshore outsourcing is, in fact, "offshore." In contact center and BPO (Business Process Outsourcing) parlance, outsourcing destinations that are closer to the US mainland are not considered offshore — they are, in fact, nearshore.

Our industry commonly refers to nearshore as any viable and lower-cost outsourcing country, territory or destination that is both “faster and easier” to travel to in comparison to the Philippines, India, other Asia Pacific (APAC) markets and even EMEA (Europe, Middle East, Africa). We speak of nearshore not only in geographical terms but also in skill sets and capabilities, as will be described later.

Nearshore is also often referenced as "the" outsourcing region with higher quality English and a large pool of bilingual agents. Again, in our own definition of nearshore + the feedback from clients that use nearshore call centers, the consensus is that any outsourcing geography that is within a three- to six-hour flight or less from major US airports is considered nearshore. Of course, there are exceptions — certain Caribbean locations require connecting flights, increasing your travel time, but they are still regarded as nearshore.

Nearshore is also often described as CALA — Caribbean and Latin America. However, CALA is somewhat of a misnomer because Latin America includes South America. Given the distance of some South American countries from the mainland USA, we are not sure if the entire South American continent can be considered part of the nearshore ecosystem as we know it today — but, certain countries in the northern region of South America are, in fact, included in the nearshore spectrum.

Our definition of nearshore focuses on:

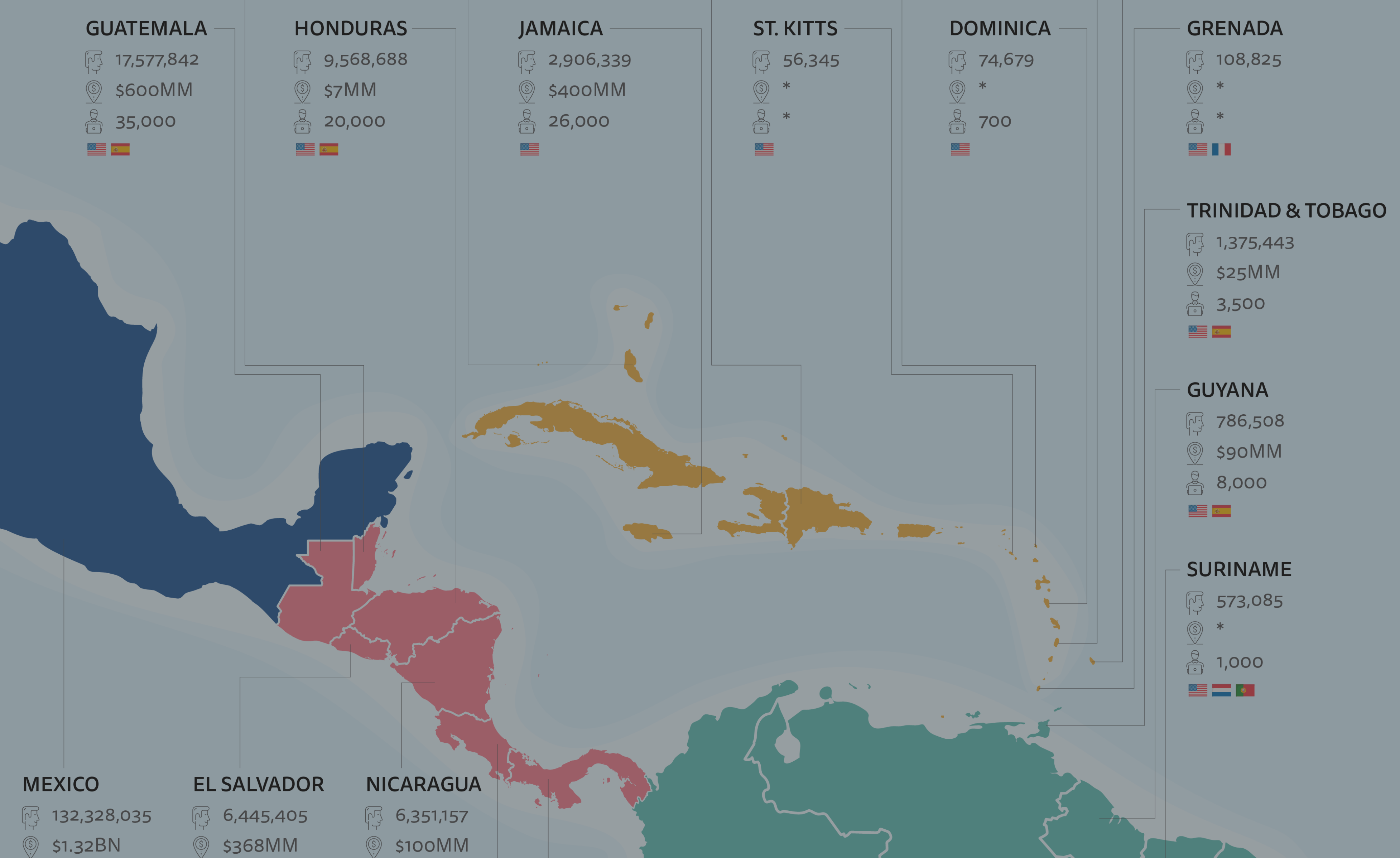

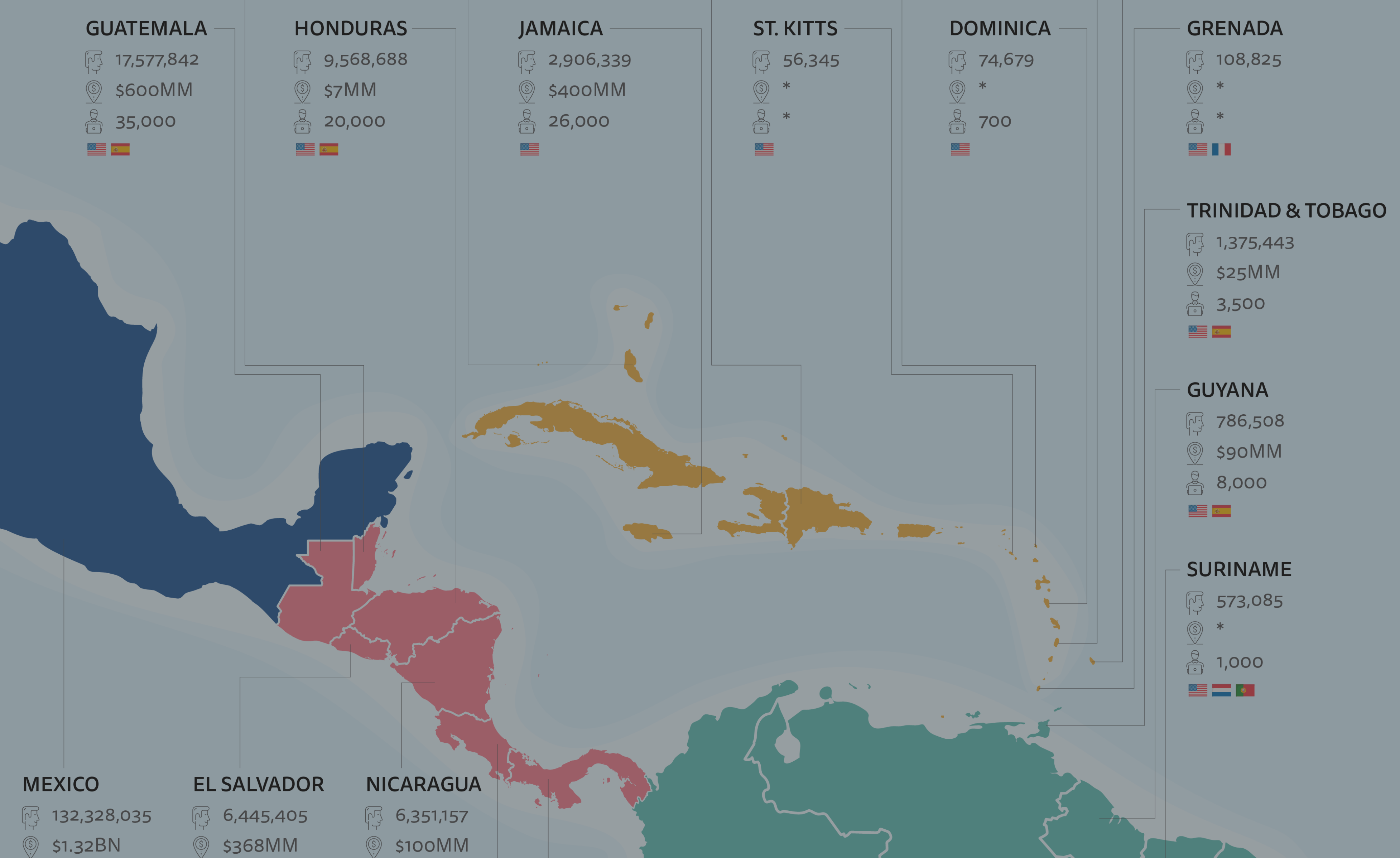

The table below provides an overview of nearshore countries and territories that have a recognized call center and BPO industry. The figures represent the most recent data that we gathered from various sources. Asterisks indicate areas where data was insufficient or unavailable, or that the industry is in early stages at present.

| Country | Population Size | Size of Call Center BPO Market ($) | # of Call Center Workers | Primary Languages Supported |

|---|---|---|---|---|

| Mexico | 132,328,035 | $1.32BN | 168,340 | English, Spanish, French, Portuguese |

| Colombia | 49,849,818 | $2.80BN | 130,000 | English, Spanish, Portuguese |

| Guatemala | 17,577,842 | $600MM | 35,000 | English, Spanish |

| Dominican Republic | 10,996,744 | $750MM | 36,000 | English, Spanish |

| Honduras | 9,568,688 | $7MM | 20,000 | English, Spanish |

| El Salvador | 6,445,405 | $368MM | 27,000 | English, Spanish |

| Nicaragua | 6,351,157 | $100MM | 9,000 | English, Spanish |

| Costa Rica | 4,999,384 | $170MM | 35,000 | English, Spanish, Portuguese, French |

| Panama | 4,226,197 | $210MM | 7,900 | English, Spanish |

| Jamaica | 2,906,339 | $400MM | 26,000 | English |

| Trinidad & Tobago | 1,375,443 | $25MM | 3,500 | English, Spanish |

| Guyana | 786,508 | $90MM | 8,000 | English, Spanish |

| Suriname | 573,085 | * | 1,000 | English, Dutch, Portuguese |

| Bahamas | 403,095 | * | * | English |

| Belize | 390,231 | $18MM | 3,000 | English, Spanish |

| Barbados | 287,010 | $45MM | 5,000 | English |

| St. Lucia | 180,454 | * | 1,200 | English, French |

| Grenada | 108,825 | * | * | English, French |

| Antigua | 104,084 | * | * | English |

| Dominica | 74,679 | * | 700 | English |

| St. Kitts | 56,345 | * | * | English |

* Insufficient or unavailable data and/or the BPO industry is early stage

Over the past few years, demand for nearshore call centers (particularly from US clients) has skyrocketed for several reasons:

Nearshore outsourcing also provides US companies with the ability to “test” the idea of lowering costs at outsourcing destinations that are closer to home. Of course, intense due diligence and correct vendor selection are required to ensure that your nearshore outsourcing endeavor is a successful one.

The Philippines remains the leading English-voice outsourcing market in the world. We have great success with our Philippines outsourcers. Yet, many clients are diversifying to nearshore markets. We can attribute this to many reasons, including:

There is also another growing concern — companies that outsource significant call volumes tend to have a VMO (Vendor Management Organization) structure with multiple vendor managers on-site in the Philippines or frequently traveling back and forth there from the USA.

But not every client has a large VMO supporting a large body of FTE. Many clients that require close collaboration with their vendors, but don’t outsource significant volume, struggle to justify using the Philippines or other farshore markets. Not every client has the travel budget or management resources to go offshore, preferring closer

In general, nearshore labor and other operating costs are higher than offshore call centers. Superior English aptitude and bilingual agents coupled with other skill sets in high demand along with geographic proximity to the USA all call for a premium above offshore pricing. When comparing nearshore vs. offshore, if you do your homework in selecting the right nearshore vendor(s), then this premium should offset by better performance. US companies that outsource nearshore can achieve a 40% to 60% cost savings compared to insourced and outsourced all in hourly rates from call centers in the USA — again, assuming you select the right nearshore vendor.

Buy cheap—get cheap!

Don’t expect below-market pricing from tier 2 and tier 3 nearshore vendors to be the panacea. In fact, lower grade nearshore vendors try to “buy business” with unsustainable low-ball rates which will cost you dearly in other ways — something we have covered in previous articles.

Lastly, some of our tier 1 nearshore vendors are starting to offer price points that are not too far off from comparable tier 1 vendors in the Philippines. We are starting to see an uptick in Philippines pricing resulting from high turnover and rising salaries (wages are growing 9% per year, according to Everest Group).

Outsourced and in-house or captive call centers nearshore started way back in the early 1990s around the time the internet was becoming a thing. In those days, running a call center was not just about managing the business; early founders worked with local governments to create policies to promote and support the industry through myriad challenges and developments.

Just ask Dave Anderson, a renowned nearshore call center pioneer

“When I first arrived in Costa Rica in 1994, no one had any idea what a call center was. All telephony was owned by the government, and our first 300 interviews resulted in fewer than 50 people who spoke passable English. We would later discover that the local development agency loaded up those first interviews with friends and family. Today, there are tens of thousands of people working in the industry, and Costa Rica helped kick off the nearshore industry as we know it today.”

As with any outsourcing geography, an influx of call centers will eventually put a strain on the labor market, leading to saturation and rising labor costs. This is something to keep an eye on throughout the nearshore spectrum.

Geopolitical instability is also a concern in the nearshore region. Unrest, contagion and spillover effects are always top of mind, and we must heed to travel warnings and restrictions. But as we have seen over the years, safety and security is always a concern no matter which country you outsource to.

Multilingual services will continue to grow nearshore, although not on a large scale, as demand increases and US clients look to outsource in-language needs closer to home in comparison to more prevalent offshore

Detractors of nearshore are concerned with scalability. In truth, the world is running out of very large, viable, English-speaking outsourcing markets like the Philippines and its predecessor, India. Scale is relative to each client — 100 seats may be considered large for some clients whereas, for many outsourcing buyers, it is a small fraction of their sourcing need.

We know of US companies that source thousands of seats within the nearshore spectrum. The fact is that the nearshore region is much smaller than the Philippines in terms of market size and maturity. But, the nearshore market does offer scale, provided that the right vendors in the right labor markets in the right countries are selected.

Overall, we believe that most nearshore countries still haven’t reached market maturity, although some have. The market will remain competitive for the years to come and, in fact, we will most likely see more complex call types and customer interactions going nearshore from US companies, in particular.

So, the outlook remains positive for nearshore with the region’s best years still to come!

The entire customerserv.com website is © Copyright 2022 by CustomerServ, Ltd. All Rights Reserved.

The customerserv.com site and its content may not be copied or duplicated in whole or part by any means without express prior agreement in writing.

Some photographs or documents contained on the site may be the copyrighted property of others; acknowledgment of those copyrights is hereby given.

All such material is used with the permission of the owner.